Key Takeaways

- Memberships and clubs do not automatically cancel when someone dies.

- Ongoing dues and renewals can quietly drain estate funds if not stopped.

- Some memberships allow pro-rated refunds, while others do not.

- Executors should document cancellations and monitor statements to ensure charges truly stop.

{{blog-cta-admin}}

After a loved one dies, large financial matters often get immediate attention, but smaller recurring charges, like gym memberships or club dues, can quietly continue for months if no one intervenes.

These memberships may feel insignificant individually, but together they can add up to hundreds or even thousands of dollars in unnecessary estate expenses. Executors who systematically identify and cancel memberships early protect estate assets and avoid awkward explanations later during estate accounting.

What Counts as Memberships and Clubs

Memberships and clubs are typically non-essential, recurring services tied to the individual rather than property ownership. Common examples include:

- Gyms and fitness centers

- Country clubs and social clubs

- Wine, coffee, or hobby clubs

- Professional or networking clubs

- Roadside assistance programs (such as AAA)

- Travel clubs or loyalty memberships

These memberships usually renew automatically unless canceled, and most providers do not receive death notifications on their own.

What You’ll Need

Before you begin, gather:

- A certified death certificate

- A list of all physical memberships

- Bank and credit card statements showing recurring charge

- Membership cards, key fobs, or recent statements showing:

- Account or member numbers

- Billing details

- Contact information

Having these details ready saves time and reduces back-and-forth with billing offices.

Step 1: Identify Every Membership

Finding all memberships often takes more effort than expected.

Check:

- Bank and credit card statements for recurring charges

- Email inboxes for renewal notices or receipts

- Physical mail for membership cards or statements

- Wallets, keychains, and glove compartments for cards or fobs

Create a master list noting:

- Organization name

- Member or account number

- Contact details

- Billing cycle (monthly vs. annual)

- Next renewal date

This list becomes your cancellation checklist.

Why Memberships Are Easy to Miss

Memberships are often:

- Paid annually or semi-annually

- Charged under unfamiliar billing names

- Set to auto-renew quietly

Executors frequently discover forgotten memberships only when reviewing months of bank statements later, after money has already been lost.

Step 2: Contact Organizations and Request Cancellation

Notify Each Organization

Reach out to the membership or billing office by:

- Phone

- Online account portal

- Formal written notice (if required)

Explain:

- The member has died

- You are acting as executor or administrator

- You are requesting immediate cancellation

Provide Documentation

Most organizations will ask for:

- A copy of the death certificate

- The member or account number

Providing both upfront speeds processing.

Request Refunds When Available

Ask whether:

- Pro-rated refunds are available for unused time

- Any deposits or prepaid dues can be refunded

Some memberships refund unused portions; others do not. Always ask, refunds are never automatic.

Return Physical Items

Ask whether you must return:

- Membership cards

- Key fobs

- Door keys

- Equipment or uniforms

Follow return instructions carefully and keep receipts or confirmations.

Step 3: Confirm Closure and Monitor Accounts

Cancellation isn’t complete until billing stops.

After cancellation:

- Save written confirmations (emails, letters, screenshots)

- Record any refunds received

- Deposit refunds into the estate account

Over the next 1–2 billing cycles:

- Review bank and credit card statements

- Confirm no new charges appear

- Follow up immediately if charges continue

Monitoring is critical, many organizations process cancellations slowly or imperfectly.

Refunds vs. Non-Refundable Fees

Executors should understand:

- Monthly memberships may offer partial refunds

- Annual memberships often do not

- Initiation fees are usually non-refundable

- Deposits may or may not be refundable depending on the contract

Refund policies vary widely, so documenting each response protects the executor.

Memberships vs. Property-Linked Obligations

Not all recurring charges are true “memberships.”

For example:

- HOA or condo dues are tied to property ownership and usually must continue until the property is sold.

- Club memberships tied to property (such as mandatory country club HOAs) may not be cancelable immediately.

Understanding this distinction avoids frustration and incorrect assumptions.

Why This Step Matters in Estate Administration

Uncanceled memberships:

- Reduce estate value

- Create accounting discrepancies

- Raise questions from beneficiaries

- Reflect poorly on executor diligence

Because executors are fiduciaries, they must prevent unnecessary ongoing expenses wherever possible.

Common Challenges Executors Face

Executors often encounter:

- Difficulty identifying all memberships

- Strict cancellation policies

- Requirements for mailed notices

- Limited office hours for returns

- Delayed refunds

- Charges continuing despite cancellation

These challenges are common, and manageable with persistence and documentation.

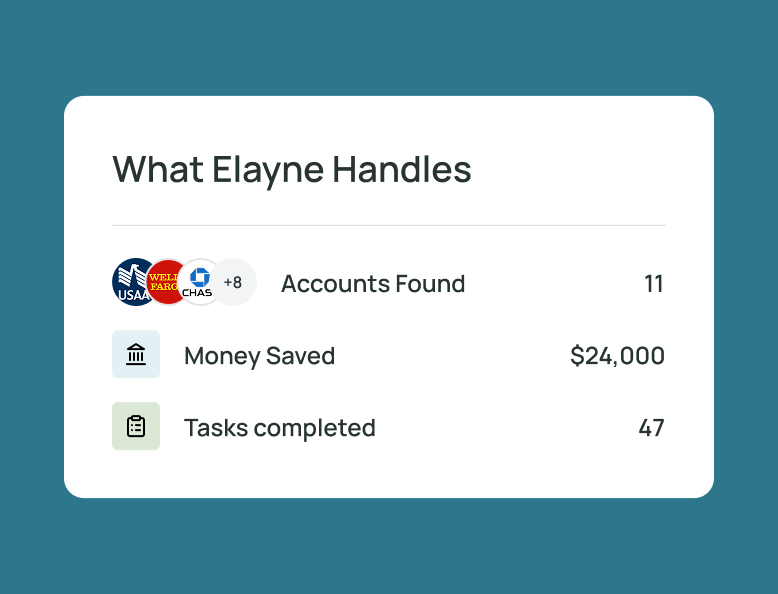

How Elayne Helps With Membership Cancellations

Elayne helps eliminate quiet financial leakage.

- Identifying recurring membership charges

- Creating a centralized cancellation checklist

- Handling outreach and documentation

- Tracking refunds and confirmations

- Monitoring for lingering charges

This frees executors from repetitive calls and follow-ups.

When Membership Issues Typically Surface

Problems often appear:

- Months into estate administration

- During final accounting

- When beneficiaries question expenses

Addressing memberships early avoids these last-minute surprises.

Conclusion

Canceling memberships and clubs after a loved one’s death is a small task with a meaningful financial impact. Because these services don’t cancel automatically, ignoring them can quietly drain estate funds and complicate final accounting.

By identifying all memberships, canceling them properly, requesting refunds where possible, and documenting each step, executors protect estate assets and fulfill their fiduciary duty.

If you’d rather not hunt down memberships, send notices, and track refunds yourself, Elayne can help identify recurring charges, handle cancellations, and keep all confirmations organized in the estate records.

{{blog-cta-admin}}

FAQs

Q: Do memberships cancel automatically when someone dies?

No. Most require direct notification.

Q: Are refunds guaranteed?

No. Refund policies depend on the membership agreement.

Q: Should I cancel with the bank as well?

If charges continue, yes—stop payments at the bank or card issuer.

Q: How long should I monitor statements?

At least 1–2 billing cycles after cancellation.

**Disclaimer: This article is for informational purposes only and does not provide legal advice. Membership agreements and refund rights vary. Consult a licensed professional for guidance specific to your situation.