After a loved one passes, it’s common to wonder whether they had life insurance and if so, where to find it. The process can feel like detective work at first, but if you have authority to act and with a few simple steps, you can usually uncover any existing policies.

{{blog-cta-financial}}

Here’s how to start your search calmly and confidently.

1. Check Personal and Financial Records

Start close to home:

- Look through filing cabinets, safes, or folders marked “insurance” or “benefits.”

- Search email inboxes for terms like “life insurance,” “policy,” “premium,” or major insurer names.

- Review bank or credit card statements for recurring payments to insurance companies.

- Check wallets, membership cards, or personal effects for insurer or group information.

2. Contact Employers or Groups

Many people have life insurance through work or professional associations:

- Reach out to current or past employers, especially HR or benefits offices.

- Check unions, alumni groups, or professional associations (teachers, nurses, police, etc.) for group coverage or small burial benefits.

3. Explore Special Programs

Some types of employment or service come with life insurance automatically:

- Veterans and military: SGLI, VGLI, or FSGLI (through the VA).

- Federal employees: FEGLI (Federal Employees’ Group Life Insurance).

- State or local workers: Public pension systems sometimes include life coverage.

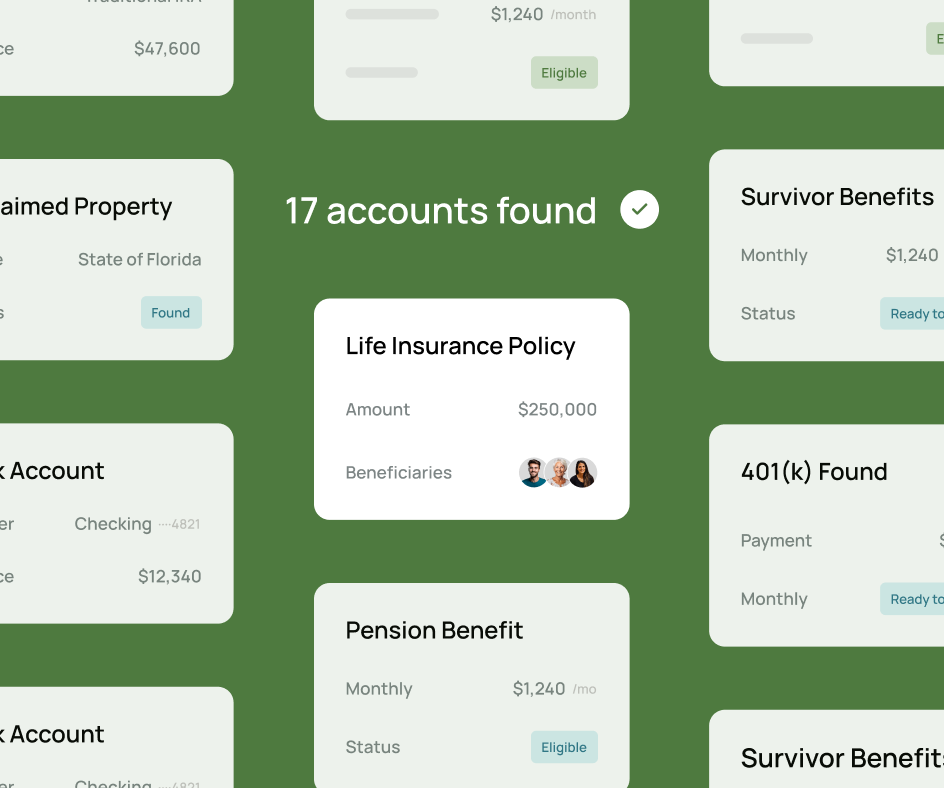

4. Use Official Policy Locators

If personal searches come up empty, these tools can help:

- NAIC Life Insurance Policy Locator: free national tool that lets insurers check their databases for policies.

- MissingMoney.com: searches unclaimed property databases, where unpaid benefits may have been turned over to the state.

- State insurance departments: some operate their own policy search services.

5. Check with the Estate or Probate Process

If the person had a will, trust, or ongoing estate case, insurance information may already be listed. You can:

- Ask the executor or attorney for documentation.

- Review probate filings, where insurance may appear as an estate asset.

- Inspect safe deposit boxes if you have authorized access—original policies are sometimes stored there.

6. What to Expect

If a policy is found, insurers will need a certified death certificate before confirming details.

Only the beneficiary, executor, or next of kin can typically access information.

If no beneficiary is located, the benefit may eventually transfer to the state’s unclaimed property office.

{{blog-cta-financial}}

Final Thoughts

Finding out whether someone had life insurance can take a little patience, but every step you take brings clarity and peace of mind. Even if no policy exists, you’ll know you’ve honored your loved one by closing this loop thoughtfully.

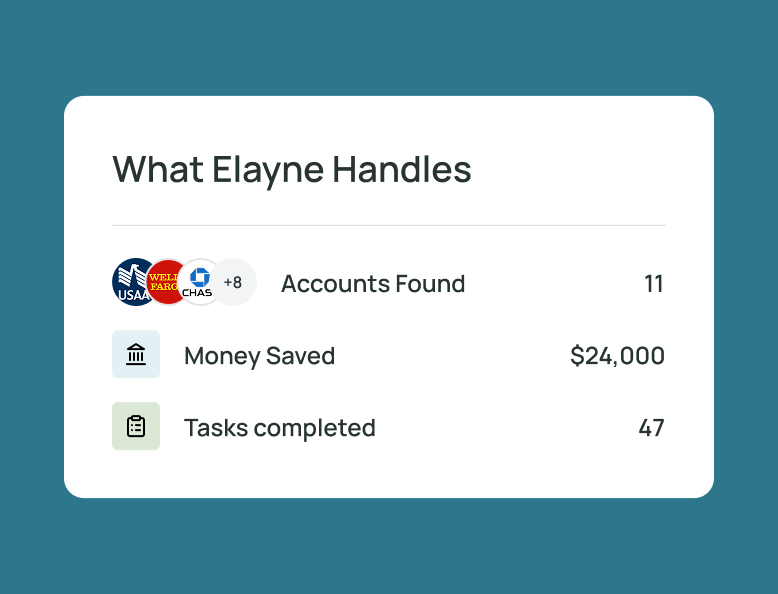

At Elayne, we help families handle these searches with empathy and structure, so that even the most technical tasks after a loss feel supported and manageable.

*Disclaimer: This article is for informational purposes only and does not provide legal, medical, financial, or tax advice. Please consult with a licensed professional to address your specific situation.