After a loss, even simple tasks can feel overwhelming—especially when it comes to something as important as a life insurance claim. The process is often more straightforward than it seems. Here’s what to do, step by step.

{{blog-cta-financial}}

1. Locate the Policy

Check for paperwork, emails, or online records. If you can’t find the policy, use the NAIC Life Insurance Policy Locator to see if one exists.

2. Gather the Essentials

You’ll usually need:

- A certified death certificate (get several copies)

- The policy number or insurer’s name

- Your photo ID and claim form from the insurer

3. File the Claim

Contact the insurer or the agent and say you’re the beneficiary. Submit the claim form with all documents by mail or online upload. Keep a copy and note your claim number for follow-up.

4. Know the Timeline

Most claims are processed within 14–60 days. It can take longer if the insurer needs more information or if the policy is under review (called the “contestability period”).

5. Understand the Payout

Payments are usually tax-free and may come as a lump sum or installments. If the named beneficiary has also passed away, funds may go to the estate through probate.

6. If There’s a Problem

If your claim is delayed or denied, ask for a written explanation. You can appeal the decision or contact your state’s insurance department for help.

Final Thoughts

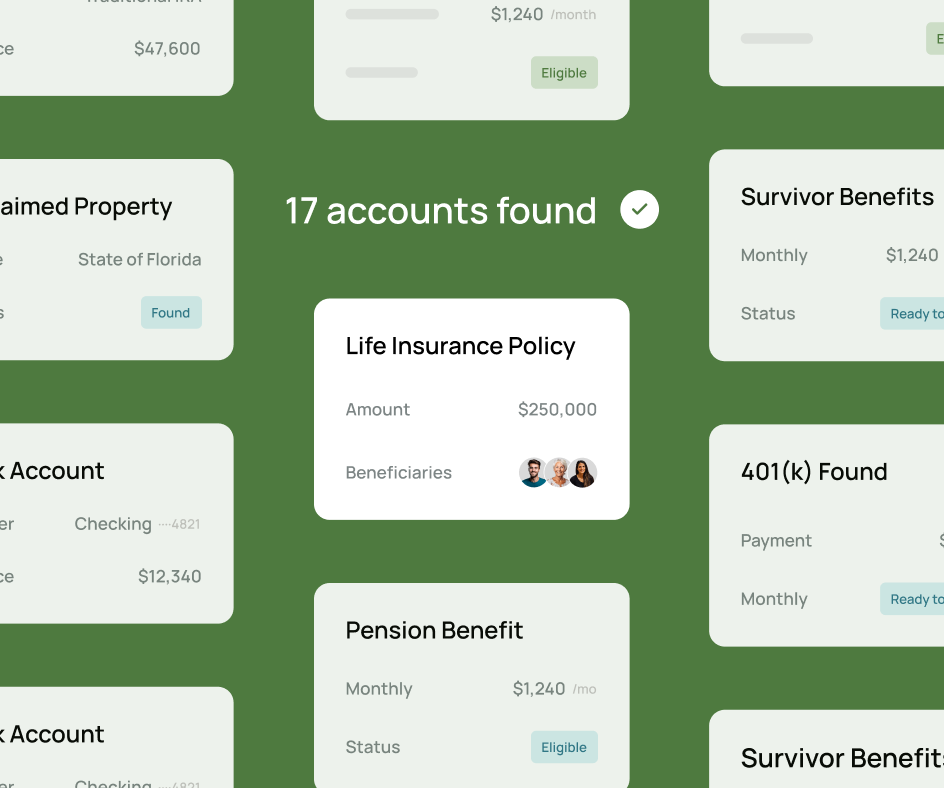

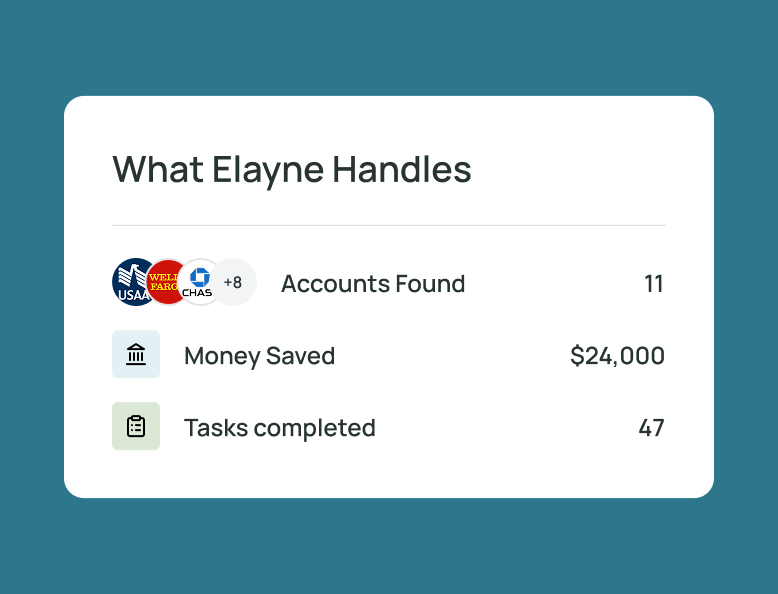

Filing a life insurance claim isn’t just about forms—it’s about honoring your loved one’s care and planning. Take your time, ask questions, and know that help is available. At Elayne, we’re here to make every step a little easier, with support that’s both practical and compassionate.

{{blog-cta-financial}}

FAQs

How long does it take to receive payment?

Usually 2–8 weeks, depending on how quickly documents are submitted and verified.

Can I file a claim if I don’t have the policy number?

Yes—contact the insurer with the person’s name, date of birth, and Social Security number.

Are life insurance payouts taxable?

Generally, no. The benefit itself is not taxable, but interest on delayed payments may be.

What if there’s a dispute between beneficiaries?

The insurer may hold the funds until the issue is resolved through the court or probate process.

How many death certificates do I need?

Most families request 5–10 certified copies, since each claim or account often requires an original.

*Disclaimer: This article is for informational purposes only and does not provide legal, medical, financial, or tax advice. Please consult with a licensed professional to address your specific situation.