Key Takeaways

- You can become an executor after death by being named in the will or appointed by the court.

- The process involves legal paperwork, court approval, and a commitment to handling the estate’s responsibilities.

- Understanding your duties upfront helps ensure a smoother estate settlement process.

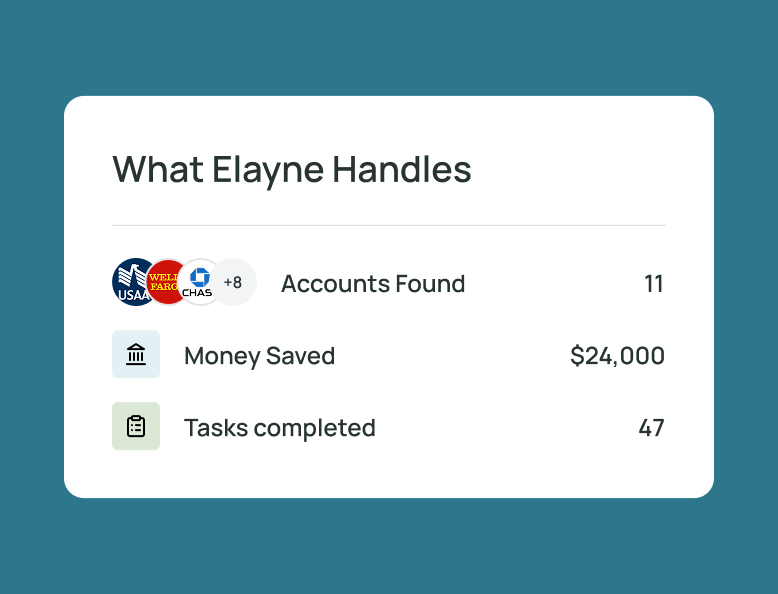

{{blog-cta-legal}}

When someone dies, families often ask: who will handle their estate? This role is filled by an executor (sometimes called a personal representative). If you weren’t appointed in advance, you may still be able to serve as executor after death through a court process.

This guide explains how to become an executor after someone has died, what steps are involved, and what you need to consider before accepting the responsibility.

What Is an Executor and What Do They Do?

An executor is the person legally responsible for managing the deceased person’s financial and legal affairs. Their duties are guided by state law and overseen by the probate court.

Key responsibilities include:

- Filing the will with the probate court

- Paying outstanding debts, bills, and taxes

- Managing property and financial accounts until distribution

- Distributing assets to heirs and beneficiaries

- Closing the estate once everything is settled

It’s a role that requires organization, patience, and careful attention to legal obligations.

Step 1: Check the Will for a Named Executor

The first step is to determine if the deceased left a valid will. Most wills name an executor chosen in advance. If you are named, you still cannot act right away. You’ll need court approval to make your appointment official.

If no executor is named, or if the named person declines, becomes incapacitated, or has died, another person (often a close relative) can petition the court to serve as executor.

Step 2: Petition the Probate Court for Appointment

If you wish to serve, you’ll need to formally petition the probate court in the county where the deceased lived. This process usually includes:

- Filing the death certificate and will (if one exists)

- Submitting probate forms required by your state

- Notifying heirs, beneficiaries, and other interested parties

The court will review your petition, and if there are no objections, it will schedule a hearing or issue an order granting your appointment.

Step 3: Receive Letters Testamentary or Letters of Administration

Once approved, the court will issue legal documents that authorize you to act on behalf of the estate:

- Letters Testamentary: issued if there is a valid will and you were named executor.

- Letters of Administration: issued if no will exists, or if the will did not name an executor. In this case, you’ll serve as the Administrator rather than Executor.

These documents give you the authority to access financial accounts, sell property, and conduct estate business.

Who Can Be Appointed If There’s No Will?

When there’s no will, state laws determine who has priority to serve as Administrator. Generally, the order is:

- Surviving spouse

- Adult children

- Other close relatives

If family members are unwilling or in conflict, the court may appoint a neutral third party (such as a professional fiduciary). To qualify, you must be a legal adult and of sound mind.

Things to Consider Before Accepting the Role

Serving as executor or administrator is not a decision to take lightly. Here are important considerations:

- Time commitment: Estates can take months or even over a year to close.

- Legal responsibility: Executors can be held personally liable if they mishandle estate funds.

- Right to decline: You are not obligated to serve, even if named in the will. You can decline or step aside in favor of someone else.

If you do accept, staying organized and seeking professional help when needed can make the process far smoother.

{{blog-cta-legal}}

FAQs

Q1: Can more than one person serve as executor?

Yes, some wills name co-executors, or courts may approve more than one person to serve together. However, this can complicate decision-making.

Q2: Do I need a lawyer to become an executor?

Not always. While some simple estates can be managed without legal help, many executors benefit from consulting a probate attorney, especially when disputes or complex assets are involved.

Q3: What happens if no one wants to be the executor?

If no family member or friend is willing, the court may appoint a public administrator or professional fiduciary to handle the estate.

Q4: Is being an executor the same as being a power of attorney?

No. A power of attorney ends when a person dies. The executor’s role only begins after death and is governed by probate law.

Becoming an executor after someone has died involves legal steps, personal responsibility, and often, emotional complexity. If you’re stepping into this role, know that help is available—from court staff to estate lawyers. Taking it one step at a time, and understanding the process before you begin, can make all the difference in settling your loved one’s estate.