Serving as your parents’ power of attorney (POA) before death is a significant responsibility that requires careful planning and proactive action. It means they’ve entrusted you to make critical financial, legal, or medical decisions on their behalf while they’re still alive. As they age or face health challenges, understanding your role and taking the right steps now can reduce stress, prevent complications, and ensure their wishes are honored every step of the way

Here’s what it means to be a power of attorney, and the most important steps to take before your parents pass away.

{{blog-cta-financial}}

Understanding the role of Power of Attorney

Power of attorney is a legal document that grants someone (the “agent”) the authority to act on behalf of another person (the “principal”) in personal, financial, or medical matters. There are different types of power of attorney, and it’s important to know which one you’ve been granted:

- General POA: Gives broad authority over the principal’s finances and legal matters.

- Durable POA: Remains in effect even if the principal becomes incapacitated.

- Springing POA: Only goes into effect once a specific condition is met, typically incapacitation.

- Medical POA (or Healthcare Proxy): Allows the agent to make medical decisions when the principal is unable to.

If you’ve been named your parents’ power of attorney, you should know what type of authority you have, and under what conditions it takes effect.

The Role of a Power of Attorney Before Death

It’s a common misconception that power of attorney continues after someone dies. It doesn’t. Once your parent passes away, the POA ends, and the executor of the estate (named in the will) takes over.

That means your role as POA is strictly for before death—so planning and acting early is essential.

Here are the key steps you should take while your parents are still living:

1. Have the Hard Conversations Early

One of the most important (but often delayed) tasks is having open, honest conversations with your parents about their wishes. This includes:

- What kind of care they want if they become ill or incapacitated.

- Where they want to live if they can no longer stay at home.

- How they want their finances managed.

- What medical treatments they do or don’t want.

- Who they want to make decisions if they’re unable.

These conversations may be uncomfortable, but they are critical. Document everything, and revisit the conversations as needed.

2. Ensure the Power of Attorney Documents Are Legally Valid

Make sure your power of attorney documentation is properly signed, notarized, and accepted under your state’s laws. In many cases, financial institutions and healthcare providers will want to see original or certified copies. You may need to submit the documents to banks, insurance companies, and doctors in advance.

Some institutions have their own internal POA forms that your parents may need to fill out. Being proactive now can save you major headaches later.

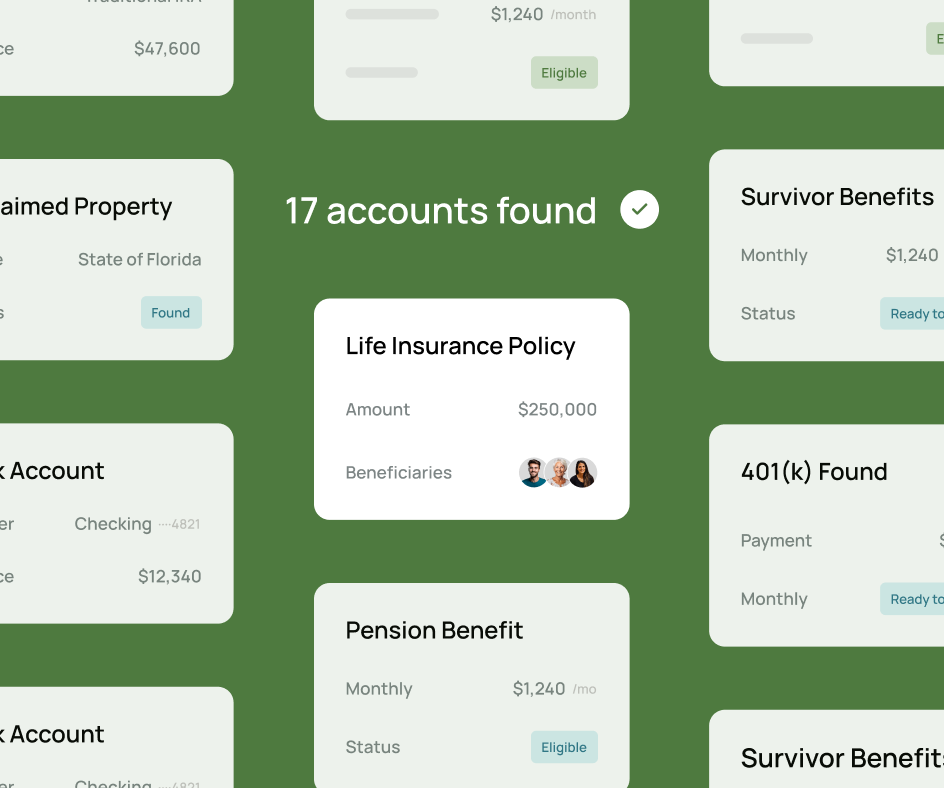

3. Get Access to Essential Financial Information

Being a financial power of attorney means you may one day need to manage your parents’ accounts. Before that happens, get a full picture of their finances:

- Bank and investment accounts

- Credit cards and loans

- Insurance policies

- Retirement plans

- Mortgage documents

- Monthly bills and utilities

- Safe deposit boxes or storage units

Ask your parents to provide you with a secure, organized list of account numbers, contact information, and passwords. Better yet, set up joint access or online accounts (with their permission) where needed. Setting up Google Inactive Account manager, for example, is a great place to start.

4. Review or Create Key Estate Planning Documents

Power of attorney is just one piece of the estate planning puzzle. To make sure you can carry out your role effectively, your parents should also have the following:

- A Last Will and Testament: Directs how their assets will be distributed after death.

- Advance Healthcare Directive (Living Will): Explains their medical wishes if they cannot communicate.

- Trusts: If applicable, these can help avoid probate and streamline asset distribution.

- HIPAA Release: Allows you to access their medical information.

Encourage them to work with a professional, or to use a tool like Elayne, to review these documents regularly and make any necessary updates.

5. Discuss End-of-Life Wishes and Funeral Plans

Though it may seem unrelated to your legal role, understanding your parents’ wishes for their funeral, burial, or memorial service can ease decision-making during an emotionally difficult time. Find out if they’ve pre-paid for any services or made formal arrangements.

6. Keep Good Records and Stay Organized

Once you begin acting as power of attorney, whether paying bills, managing investments, or making healthcare decisions, keep detailed records of every action you take on their behalf. These records will protect you legally and help ensure transparency among family members.

Keep copies of:

- Financial transactions

- Medical decisions

- Signed agreements

- Receipts or invoices

Organize everything in a secure, easy-to-access place, whether that’s a digital folder, cloud storage, or a locked filing cabinet.

{{blog-cta-financial}}

Why Estate Planning Makes Being Power of Attorney Easier

Estate planning is more than just paperwork—it’s the foundation for clarity, peace of mind, and smooth transitions. When your parents have a comprehensive estate plan in place, it empowers you to make decisions confidently and ensures their wishes are honored. It also reduces the risk of family conflict, financial mismanagement, or legal issues down the line.

Being named as your parents’ power of attorney is an honor—but it’s also a role that requires forethought, responsibility, and compassion. The best thing you can do is act before a crisis happens. Help them get organized, ensure their estate plan is up to date with the help of Elayne, and prepare yourself to step in when needed.