Key Takeaways

- Checks made out to someone who has died must be handled by their estate.

- Legal authority is required to deposit or request the reissue of the check.

- Estate accounts or reissued checks are the proper methods for handling these funds.

{{blog-cta-checklist-small}}

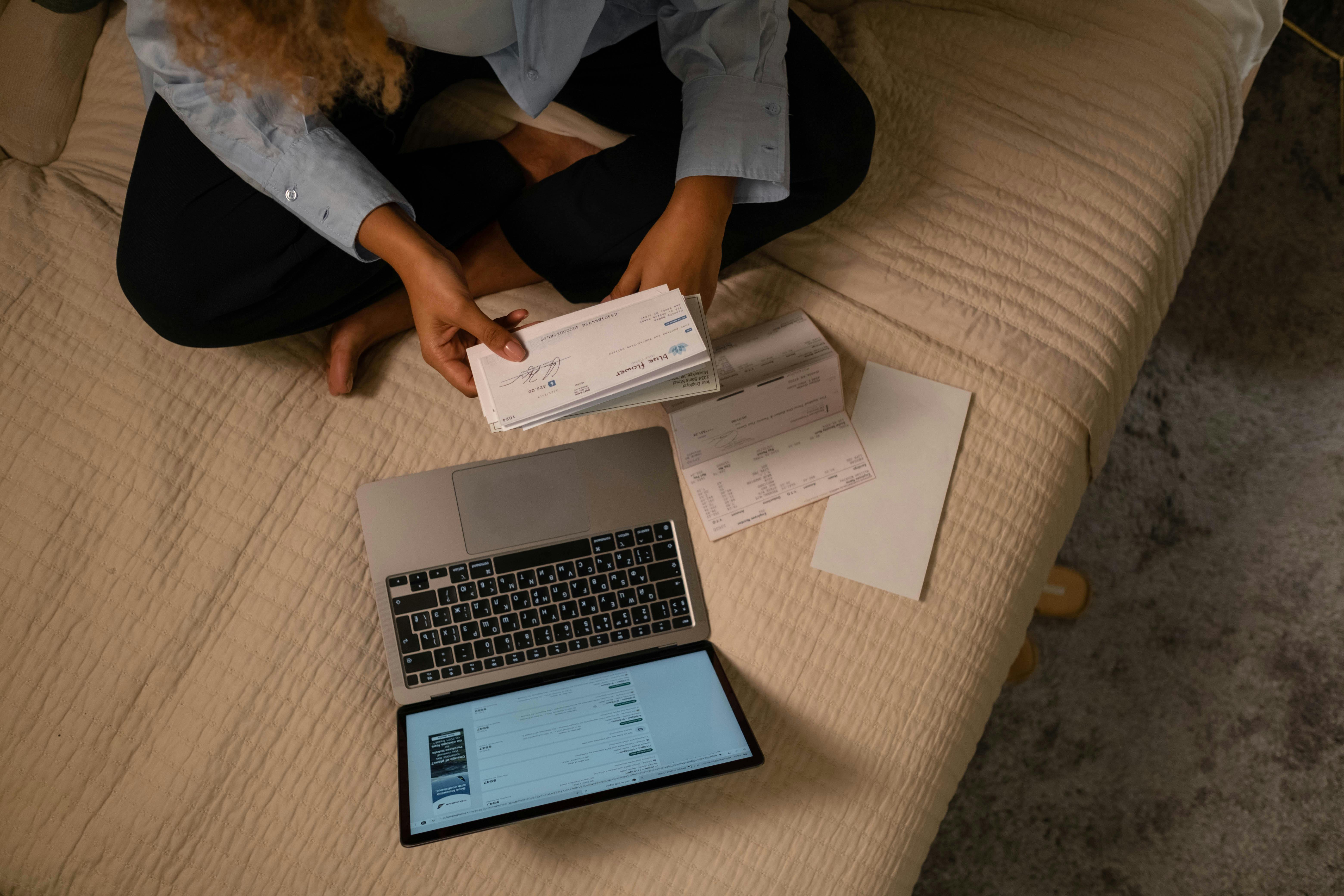

When it comes to the administrative side of loss, there are many financial tasks that must be managed. One of the most common is handling a check made out to the deceased, whether it’s a final paycheck, a refund, or a government benefit. While it may seem simple to deposit the check into your own account, banks cannot legally allow this. Understanding how to cash a deceased person’s check helps you avoid delays, legal issues, and rejected deposits. If you have authority to act, this guide explains how to cash a check payable to a deceased person and the steps needed to do it properly.

Why You Can't Deposit It Into a Personal Account

Once someone passes away, any money owed to them becomes part of their estate. That means:

- Banks are legally prohibited from depositing checks payable to a deceased person into a living person’s account.

- Even if you were a spouse, child, or joint account holder, the check is still considered estate property.

- Checks must be handled through the estate, not by individuals.

What You Need to Process the Check

- A Certified Copy of the Death Certificate

- Banks and issuers need proof that the person is deceased before releasing funds or reissuing checks.

- Proof of Legal Authority

- Letters Testamentary (issued when there is a will).

- Letters of Administration (issued when there is no will).

- Small estate affidavit (allowed in some states for simple estates).

- An Estate Bank Account

- You must open a bank account titled in the name of the estate (e.g., Estate of John Doe). This account is where all checks payable to the deceased should be deposited.

How to Deposit or Reissue the Check

Once you have the estate account and legal authority, you can take the following steps:

Option 1: Deposit the Check Into the Estate Account

As executor or administrator, you can endorse the check using a phrase such as “For deposit only into the Estate of [Name], by [Your Name], Executor.” The bank will then process the deposit.

Option 2: Request a Reissued Check

Sometimes banks or issuers will not accept checks written to the deceased, even with documentation. In these cases:

- Contact the issuer (employer, IRS, insurance company, etc).

- Request that the check be reissued to the estate.

- Provide copies of your documents proving authority.

This is usually the simplest method for handling the funds. When it comes to cashing a check made out to a deceased person, remember: it’s often easier to have the check reissued than to deposit the original.

Handling Government or Tax Refund Checks

Government-issued checks come with extra rules. When figuring out how to cash a tax refund check for a deceased person, it’s important to be aware of IRS procedures:

- IRS Refund Checks. If a tax refund arrives after someone has died:

- The IRS may require Form 1310 (Statement of Person Claiming Refund Due a Deceased Taxpayer).

- If the estate has a court-appointed personal representative, this form may not be needed.

- The refund check should be deposited only into the estate account.

- Other Government Checks. Benefits such as Social Security, veterans payments, or state refunds:

- Often must be reissued to the estate.

- Cannot legally be deposited into a personal account.

- This ensures compliance with federal and state regulations.

Common Mistakes to Avoid

- Depositing the Check Into a Personal Account. Even if the bank doesn’t catch it initially, the deposit can be reversed, leading to overdrafts or legal issues.

- Relying on Power of Attorney. Power of attorney ends at death. It cannot be used to cash, endorse, or manage funds.

- Waiting Too Long. Many checks expire after 90–180 days. Delays in probate or paperwork may require reissuance.

- Not Opening an Estate Account. You cannot bypass the estate process. All funds must go through an estate account or be reissued to the estate.

Conclusion

Handling a check after someone dies is a sensitive but necessary task. Understanding how to cash a check for a deceased person ensures you follow legal procedures, protect the estate, and prevent delays. With the right documents—death certificate, legal authority, and an estate account—the can process can be managed correctly.

{{blog-cta-checklist-large}}

FAQs

Q: How to cash a check written to a deceased person?

Deposit it into an estate account or have it reissued to the estate. You must show legal authority.

Q: How can I cash a check for a deceased person?

Only as the estate’s legal representative. Personal deposits are not allowed.

Q: Can I cash a check for someone who has died?

Only if you are authorized to act for the estate. The funds belong to the estate.

Q: How do you get money from a deceased person’s checking account?

A court-appointed executor or administrator must access the account.

Q: Can you cash a check made out to someone who’s passed away?

Yes, but only through the estate account or by reissuing the check to the estate.

*Disclaimer: This article is for informational purposes only and does not provide legal, medical, financial, or tax advice. Please consult with a licensed professional to address your specific situation.