Key Takeaways

- Take time to grieve while focusing on immediate practical needs like death verification and funeral planning.

- Gather essential documents and secure your mother’s home and accounts.

- You don’t have to manage estate matters alone—resources and support are available.

{{blog-cta-financial}}

Losing a mother can feel like losing your anchor. The emotional weight is immense, and yet, you may be expected to take the lead in handling practical matters.

If you're asking yourself, "My mom just died, what now?"—you’re not alone. This guide offers both compassionate direction and clear next steps to help you manage your mother’s passing, from funeral planning to settling her estate.

What to Do Right After Her Death

If your mother passed away at home and wasn’t under hospice care, you must call emergency services so a medical professional can legally pronounce her dead. If she was in hospice care, contact the hospice team.

Next, notify close family members and friends. This is not only important emotionally, but practically, they may want to assist or be involved in immediate plans.

If your mom ever discussed her end-of-life wishes (regarding funeral type, body donation, etc.), take those into account now, even if nothing was written down.

Begin Funeral Arrangements

One of the earliest decisions is choosing a funeral home. They’ll guide you through transportation, paperwork, and service planning.

Determine if your mom had prepaid funeral arrangements, burial insurance, or documented her preferences. These might be in a file, safe, or in her will.

Then, make decisions about burial vs. cremation, type of service, and who should be notified. Start informing extended family, close friends, and any relevant religious or cultural communities.

Secure Her Home and Personal Belongings

If your mother lived alone, it’s important to secure her residence. Lock all doors and windows, collect spare keys, and consider changing locks if many people had access.

Care for any pets or dependents immediately. This could mean rehoming or arranging temporary care.

While the instinct may be to begin clearing out the house right away, it’s best to wait. Legal processes may dictate how belongings are handled, especially if there's no will.

Gather Legal and Financial Documents

You’ll need certain documents quickly. Locate her:

- Will or trust

- Insurance policies

- Social Security card or number

- Marriage certificate, if applicable

- Financial account statements (banks, retirement, investments)

You’ll also need certified copies of the death certificate—often 10 or more—to handle various institutions.

Check whether she appointed a power of attorney (which ends at death) or named an executor in her will. This person will now have the authority to act on behalf of the estate.

Notify Relevant Institutions

Begin contacting agencies and companies where your mother had relationships. Common ones include:

- Social Security Administration (SSA): Report her death and ask about survivor benefits if applicable.

- Banks and Credit Unions: Freeze or close accounts as needed.

- Insurance Companies: File claims for life insurance or burial policies.

- Credit Card Companies and Lenders: Notify them to prevent unauthorized use.

- Utilities and Subscriptions: Cancel or transfer services.

- Healthcare Providers: Inform doctors, dentists, and others to stop billing.

Also, secure or close digital accounts—social media, email, and online banking—and safeguard devices.

Start the Estate Process

If your mom had a will, the executor will submit it to probate court to begin the legal distribution of assets.

If she died without a will, the estate goes through intestate succession, meaning the state decides who inherits what, usually starting with spouses and children.

This process can be complex. Don’t hesitate to hire an estate attorney, especially if:

- There’s no will

- The estate includes real estate or debt

- There are conflicts among heirs

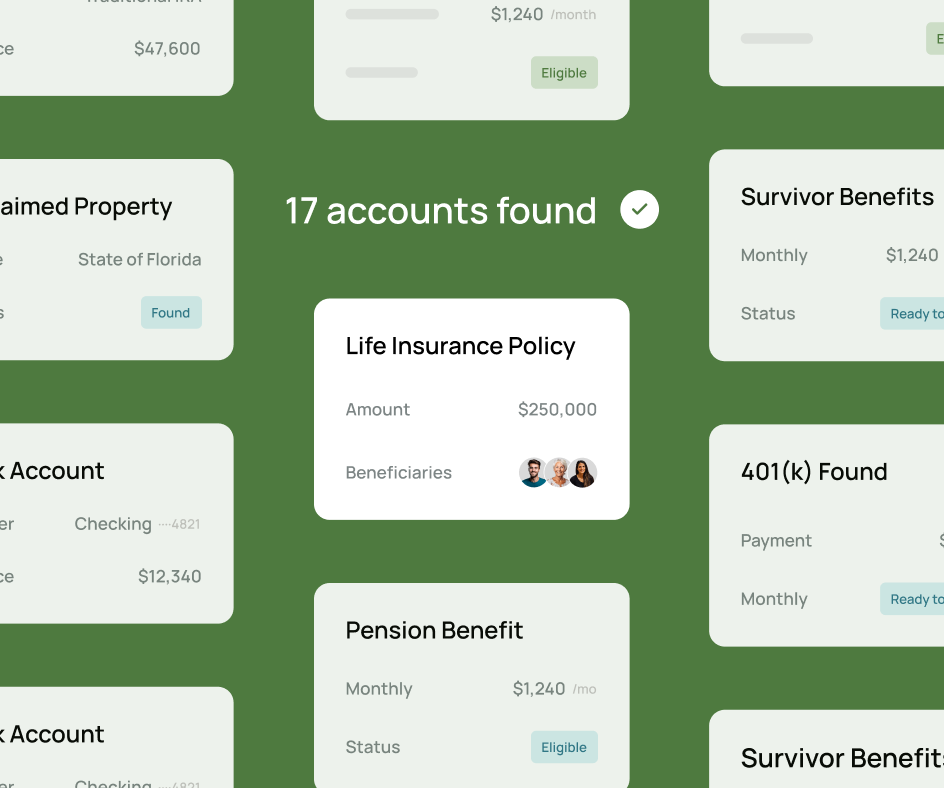

Elayne’s post-loss estate management automation simplifies the paperwork, helping families settle estates with ease during overwhelming times.

Emotional Care and Family Support

Practical steps aside, grief needs time. You may feel numb, overwhelmed, angry, or everything at once.

Try not to rush emotional recovery—or expect the same timeline from siblings or other relatives. Grief can complicate family dynamics, so prioritize honest and respectful communication.

Consider seeking help through:

- Grief counselors or therapists

- Religious or spiritual leaders

- Support groups, both local and online

Taking care of yourself isn't selfish—it's essential.

{{blog-cta-financial}}

FAQs

Q: What should I do in the first 24 hours after my mom dies?

Call hospice or emergency services to legally verify the death. Notify close family. Secure her home and look for any final wishes or documents.

Q: What if I can’t find her will?

Search common places: filing cabinets, safes, or online storage. If it can't be found, the estate will proceed under your state’s intestate succession laws.

Q: Can I handle this without a lawyer?

It depends. Small, simple estates can sometimes be settled without legal help. Larger or contested estates usually require legal guidance.

Q: How do I access her bank accounts?

You’ll need a death certificate and proof of your legal authority—such as being the named executor or administrator through probate.

Q: What happens to her debts?

Debts are paid from the estate before any assets are distributed. You are not personally responsible for her debts unless you were a co-signer.

Losing your mother is deeply personal and profoundly difficult. Amid grief, there are steps that must be taken—but you don’t have to take them all alone.

Whether you need legal clarity or emotional support, Elayne’s automated estate settlement platform is designed to help with settling estates—so you can focus on healing.

No checklist after your mom dies will ever capture everything, but this guide can help lighten the load. With time, support, and care, you’ll find your way forward while honoring her memory.