When someone you love passes away, grief already fills every corner of daily life. So when a letter arrives from a collection agency, addressed to your loved one, it can feel like a punch to the heart. You may wonder if you’re supposed to do something, or if you somehow did something wrong.

You didn’t. These moments are more common than most families realize, and knowing what they mean can help you take the next steps with more peace of mind.

{{blog-cta-financial}}

You’re Not Personally Responsible

Even if a collection letter looks urgent, you are not personally responsible for a loved one’s debts unless you co-signed or shared a joint account. Outstanding balances are handled through the person’s estate, not by surviving family members.

Why These Letters Arrive

Creditors and agencies often take time to update their records after a death. Automated systems may still send letters before the information catches up. Sometimes, these notices arrive even when no money is owed. It’s unsettling, but it’s rarely a reflection of anything you did wrong.

What To Do

- Pause and breathe. You don’t need to react right away.

- Verify the debt. Confirm it truly belongs to your loved one. You can request proof in writing.

- Notify the sender. A short note or copy of the death certificate helps close the account.

- Don’t pay personally. Unless you’re legally responsible, you don’t need to use your own funds.

- Keep copies. Save all correspondence in one place for future reference.

When It Feels Heavy

These letters aren’t just paperwork, they’re emotional reminders of someone you love. Families often tell us that seeing a name in the mail months later reopens wounds they thought were healing. It’s okay to set the envelope aside for a while, or ask someone you trust to help.

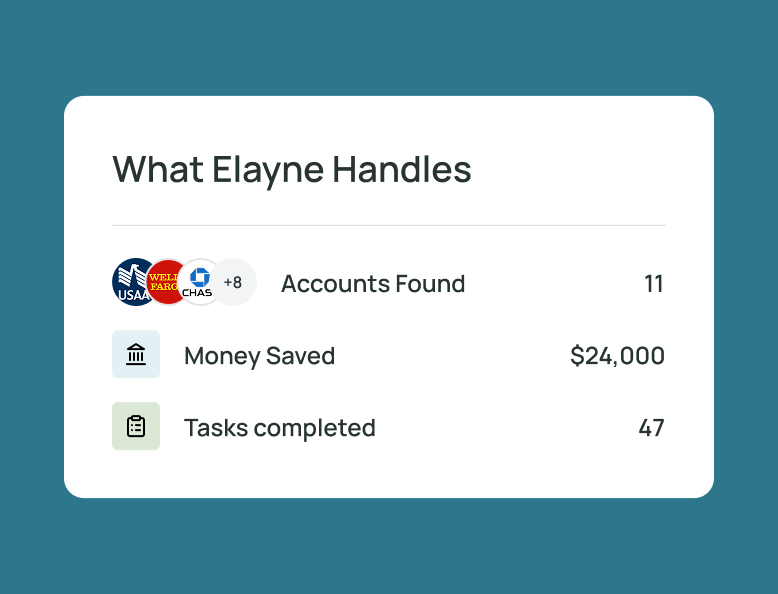

If you ever feel unsure, Elayne’s team is here to guide you through the process with care, clarity, and respect, so you can focus on remembering, not managing mail.

Final Thoughts

Letters from collections can make grief feel even heavier, but they don’t have to define this chapter. Understanding what’s happening, and knowing that you are not alone, brings comfort and confidence.

At Elayne, we believe support should be both practical and compassionate. Every step, no matter how big or small, deserves kindness and understanding.

{{blog-cta-financial}}

FAQs

Do I have to pay my loved one’s debts?

No. Unless you were a co-signer or shared a joint account, the estate is responsible, not you.

Should I ignore collection letters?

Don’t ignore them completely. Send a brief notice about the death, then let the estate process handle the rest.

Can collectors keep contacting me?

They can reach out to find the estate representative, but you can ask them to stop further contact.

What if the estate has no money?

If there are no assets, most debts are written off and no further action is needed.

*Disclaimer: This article is for informational purposes only and does not provide legal, medical, financial, or tax advice. Please consult with a licensed professional to address your specific situation.