Key Takeaways:

- Most estates take 6 to 18 months to close, depending on complexity and local laws.

- Executors must follow a legal process before finalizing and distributing assets.

- Delays often result from court schedules, creditor claims, tax issues, or family disputes.

{{blog-cta-legal}}

When a loved one passes away, next of kin often wonder how long it takes to close an estate.

The answer is rarely “quickly.” Even in the simplest cases, closing an estate involves legal, financial, and administrative steps that take time. For executors, the process can feel like juggling court paperwork, taxes, and family expectations all at once. For beneficiaries, it can feel like waiting for a train that’s always “just a little delayed.”

Understanding the estate closing timeline helps everyone manage expectations. In this guide, we’ll explain the typical duration, the steps involved, what causes delays, and what you can do if things get stuck in neutral.

What It Means to “Close” an Estate

“Closing” an estate means that all matters related to the deceased’s finances have been fully resolved. This typically includes:

- Settling all debts and taxes owed by the estate.

- Distributing remaining property or funds to beneficiaries as outlined in the will (or state law if there’s no will).

- Filing final paperwork with the probate court so the estate is officially closed.

Once the court accepts the executor’s final accounting, the legal responsibility ends, and the estate is no longer active.

Average Timeline for Closing an Estate

While there’s no single answer to how long an estate takes to close, most fall into these general ranges:

- Simple estates (6–9 months) – This might be the case if there’s no real estate, minimal assets, and no disputes. Some states allow a simplified process if probate isn’t required.

- Probate estates (9–18 months) – Most estates that require probate fall into this range. Court oversight, notice to creditors, and tax filings extend the timeline.

- Complex or contested estates (2–3+ years) – Disputes over the will, complicated assets (like businesses), or multi-state property can significantly lengthen the process.

Key Steps That Affect the Timeline

An estate closing timeline is shaped by specific legal and administrative steps, including:

- Locating the will and opening probate – This is the formal start, which can take weeks if paperwork is missing.

- Notifying creditors and settling debts – Creditors must be given a set period (often 3–6 months) to file claims.

- Filing final taxes and paying expenses – The IRS and state tax authorities must be satisfied before distribution.

- Getting court approval for distribution – Probate courts review the executor’s final accounting before assets are released.

Factors That Can Delay Estate Closure

Even well-organized executors can encounter roadblocks:

- Missing documents or unlocated assets – Bank accounts, deeds, or stock certificates can take time to track down.

- Family disagreements or legal challenges – Disputes over who gets what can send the process into legal limbo.

- Slow court systems or multiple jurisdictions – Out-of-state property requires extra probate filings.

- Unpaid taxes or unresolved finances – Tax audits, disputes over valuations, or large debts can hold up closure.

Deadlines Executors Must Follow

While there’s usually no hard universal deadline for closing an estate, there are timelines and duties executors must follow:

- Regular court updates – Most states require periodic reports or status updates during probate.

- State-specific closure limits – Some states have statutory guidelines (often around one year) for completion unless an extension is requested.

- Accountability for delays – Executors can be held personally liable or removed if they cause unreasonable delays or mismanage the estate.

What Beneficiaries Can Do If the Estate Is Taking Too Long

Beneficiaries aren’t powerless if the estate feels stuck:

- Ask for updates – A good executor should provide a clear timeline and explain any setbacks.

- Request court oversight – If delays seem unjustified, beneficiaries can ask the probate court to intervene.

- Seek legal help – An attorney can review whether the executor is fulfilling their duties or if action is needed.

{{blog-cta-legal}}

FAQs

Q1: Can an estate be closed without going through probate?

Yes. If the estate qualifies for a small estate affidavit or other simplified procedure, you can avoid full probate and close the estate more quickly.

Q2: What happens if the executor takes too long to close the estate?

If delays are excessive and unjustified, beneficiaries can request court intervention. The court may set deadlines, remove the executor, or appoint someone else.

Q3: Are there legal deadlines to close an estate?

Some states set guideline deadlines (often 12–18 months), but extensions are common if there’s a valid reason, like ongoing litigation or tax issues.

Q4: Can beneficiaries speed up the process?

Directly, no—but they can help by cooperating with requests for documents, resolving disputes quickly, and encouraging the executor to stay on track.

How long do you have to close an estate? While there’s no single deadline, most estates take 6–18 months to finalize. The exact probate duration depends on the complexity of the assets, the efficiency of the executor, and the speed of the court system.

If you’re involved in settling a loved one’s estate, patience and clear communication can help make a slow process smoother. And if delays are causing concern, legal advice or court oversight may help get things back on track.

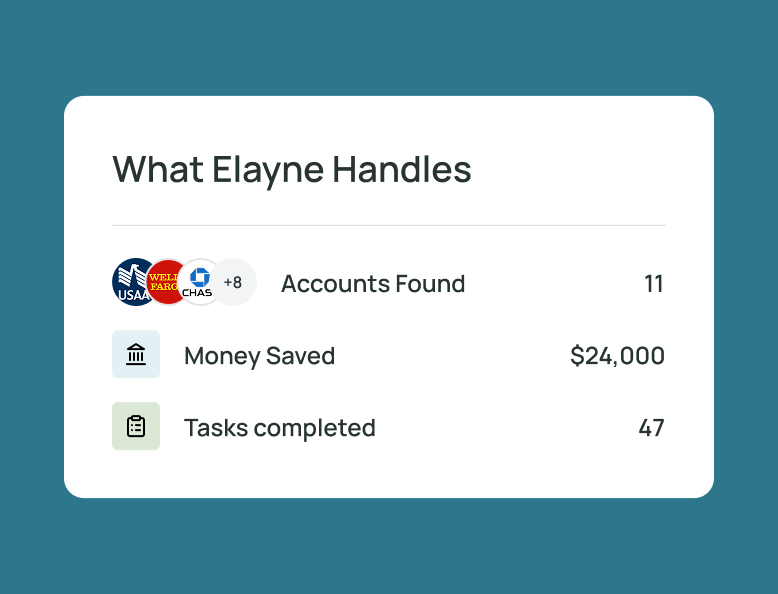

Plan Ahead, Close Faster

Elayne’s tools help families and executors manage the estate process with less stress and more clarity. Whether you need to streamline probate tasks or plan your own legacy, start here: