Key Takeaways

- Start by checking employer records and financial documents for signs of a 401(k) or pension.

- The beneficiary form for a 401(k) is managed by the plan administrator—it’s separate from the will or HR file.

- Spouses and dependents may qualify for survivor benefits under pension plans.

- You’ll need a death certificate, proof of relationship, and ID to begin a claim.

- If the company no longer exists, contact the Pension Benefit Guaranty Corporation (PBGC) for help locating old pensions.

{{blog-cta-financial}}

Step 1: Check if a 401(k) Exists

Start by contacting your loved one’s employer HR or benefits office. They can confirm if a 401(k) was offered and direct you to the plan administrator (Fidelity, Vanguard, Empower, etc.).

You can also look for clues yourself:

- Mail or email statements from financial institutions

- Tax forms like W-2s or 1099-Rs (which show contributions or distributions)

- Pay stubs with 401(k) deductions

- Bank statements showing automatic deposits or withdrawals

If you’re still unsure:

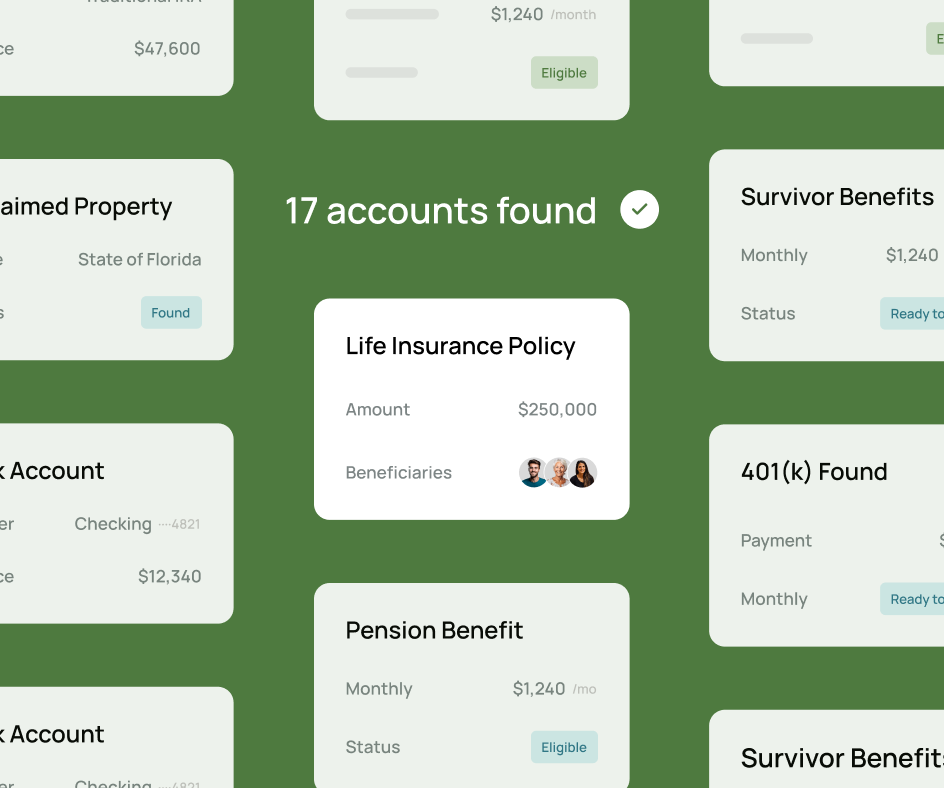

- Search the DOL Form 5500 database to confirm the employer had a plan

- Check the National Registry of Unclaimed Retirement Benefits for inactive accounts

- Look on MissingMoney.com for unclaimed checks or small balances

Step 2: Understand the 401(k) Beneficiary Form

Every 401(k) has a beneficiary designation form kept by the plan administrator. This document, not the will, determines who receives the account.

- If you’re listed, you can start the claim process with a death certificate, photo ID, and claim form.

- If no beneficiary was listed, the plan usually defaults to the spouse.

- If there’s no spouse, the balance may go to the estate, which means it will pass through probate before it can be distributed.

Step 3: Explore Pension Survivor Benefits

If your loved one received or was eligible for a pension, you may be entitled to ongoing payments or a one-time distribution.

Common benefit types include:

- Monthly survivor annuity (a portion of the pension continues for the spouse’s lifetime)

- Benefits for dependent children under certain plans

- Lump-sum payout if the plan allows

To start:

- Contact the employer’s HR or pension administrator.

- If the company no longer exists, reach out to the Pension Benefit Guaranty Corporation (PBGC)—they manage and protect many private pension plans.

You’ll likely need:

- A certified death certificate

- Proof of relationship (marriage or birth certificate)

- The decedent’s Social Security number

Step 4: What to Expect

Once the claim is filed, processing can take 30–90 days, depending on the provider. If multiple accounts exist, each will require its own claim form.

Funds from a 401(k) or pension can be rolled into an inherited IRA, taken as a lump sum, or paid as ongoing survivor benefits, depending on the plan rules and your needs.

Final Thoughts

Finding and claiming retirement benefits can feel daunting, but it’s one of the most meaningful steps you can take to honor your loved one’s work and legacy. Each account you locate is a piece of their care and planning.

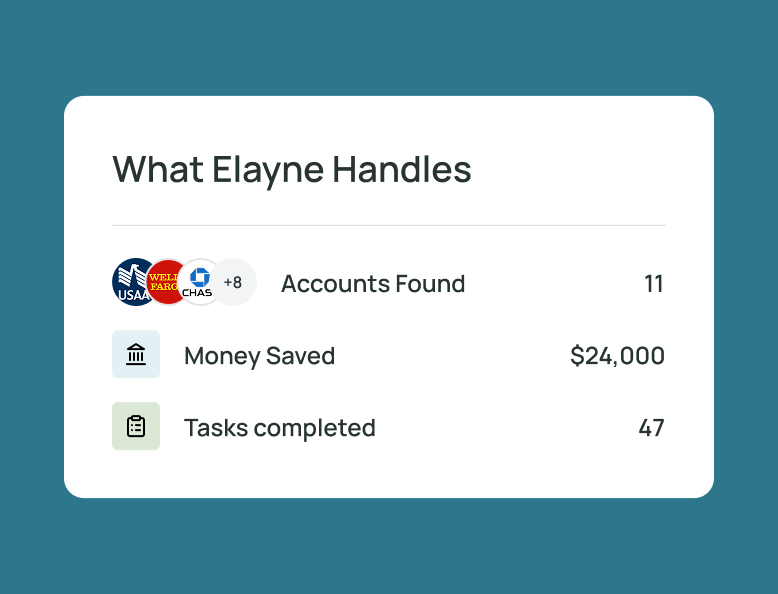

At Elayne, we help families handle these searches, organize documents, and manage claims, so that every part of this process feels supported and clear.

{{blog-cta-financial}}

FAQs

How do I find out if my loved one had a 401(k)?

Start with their last employer’s HR or benefits department. You can also check old pay stubs, tax forms, or use the National Registry of Unclaimed Retirement Benefits.

What happens if no beneficiary was listed on the 401(k)?

The plan usually defaults to the spouse; if there’s none, it may pass through probate as part of the estate.

Are 401(k) or pension benefits taxable?

Yes, in most cases. Retirement benefits are treated as income for the beneficiary when distributed.

What if the company no longer exists?

Contact the PBGC, they manage many terminated pension plans and can confirm if benefits remain.

How long does it take to receive the funds?

Typically 1–3 months, depending on how quickly forms and documents are submitted.

*Disclaimer: This article is for informational purposes only and does not provide legal, medical, financial, or tax advice. Please consult with a licensed professional to address your specific situation.